Iran Plans Rapid Expansion of It's Rail and Logistics Networks to Offer Fantastic Import and Export Opportunities For Iranian Companies and Partners Overseas in 2016

7 Jan 2016

The White Rose Group has been saying for a while that Iran is set to ride out front as the main transportation and logistics hub for connecting of regional partners to overseas trade and broadening their import and export business opportunities.

Despite recent events reported in the news, trade sanctions against Iran still look set to be lifted as agreed in Geneva last year. In the run up to this landmark day, Tehran is being courted by potential international partners to establish business infrastructure and agreements in readiness. The people of Iran and Iranian companies look to be the beneficiaries of oil based trade, in spite of tumbling oil prices over the past year. Iranian leaders will be able to pay for good imports with doubled oil production to be sold on global markets. For trade with Iran to run smoothly, the transport infrastructure improvements need to continue.

A National Rail Network For Iran

A recent Global Construction Review article claimed that only about 11% of the people who travel in Iran do so by train for a variety of reasons relating to inconvenience. Tehran recognises rail networks across the whole of Iran as a strategic priority. As we write, rail track covers just short of 13,000km of Iran. This compares poorly with more developed economies with equivalent populations cited by GCR, e.g. UK, which is seven times smaller than Iran, but has over 4,500km more rail freight infrastructure.

Hostile mountain and desert terrain makes truck transportation logistics dangerous and increases risk of deaths and financial losses. While air freight is expanding rapidly, it is not enough alone to meet demand for intercity business freight and passenger travel.

Even large cities such as Hamedan’s 500,000 residents and businesses are not served by rail infrastructure and transport over land can involve time consuming, circuitous journeys e.g. the Shiraz - Bandar Khomeyni route. This holds back Iran’s expansion into diversified businesses and feeds a dependence on oil exports.

Tehran’s Transport Infrastructure Plans

Last year, the Director of the Republic of Iran Railways (RAI), Mohsen Poursaeed-Aqaei, announced $25bn worth of rail projects, together with incentives for encouraging domestic and foreign investment, anticipating increased demand after the lifting of sanctions. A decade from now the RAI plan to establish electrified, double-tracks and about 12,000km of new lines, potentially doubling capacity.

The Bandar Abbas – Bafgh link was established several years ago out of the necessity of freight tracking of oils. This was followed by the Isfahan – Shiraz track. This link connected over 3 million city dwellers and the two rail-links together started Iran’s rail service. Now new areas need to be looked at for allowing for greater freedom of movement of families and businesses.

Turning Point In developing Scaled Transportation and Logistics Routes

Beyond Iranian citizens needing scaled up rail links, our leaders need to maximise Iran’s perfect situation for connecting Europe, Asia and Africa. This is the aim of the routes currently under development or discussion: the International North-South Transport Corridor (INSTC) and the China to Europe Silk Road, giving access to overseas shipping routes via the Pacific, Indian and Atlantic oceans

Iran’s Gulf coast means South Asian trade partners, such as India will be able to reach Moscow and Europe in half the time it used to take via the traditional Suez Canal route. Recent INSTC developments doubly beneficial for Iranian companies and regional business partners, because if time is money’ there could be savings of around $2,500 for every 15 tonnes of cargo according to GCR’s reporter.

The route’s completion has been a long time in the making, with Iran, Russia and India having signed an agreement over INSTC’s development as long ago as 2000, held back by the US and EU sanctions against Iran. Indian companies in particular need these connected routes to progress, in order to cut out Pakistan as their route to Afghanistan and other Central and East Asian trade partners.

China’s Silk Road is the ribbon binding Beijing to Central Asian markets, cutting down on the slow boat to Europe. The plans here include a “high-speed standard gauge line running through central Asia”. This would “…slice through a knot of broad gauge lines in the states of the former Soviet Union”. .

Both the stakes riding on the Iran’s rail schemes and the pay backs for Iran’s economy and Iranian companies and people are high. In fact, rail infrastructure innovation in the region is setting the stage for 21st century import and export business opportunities for millions of people.

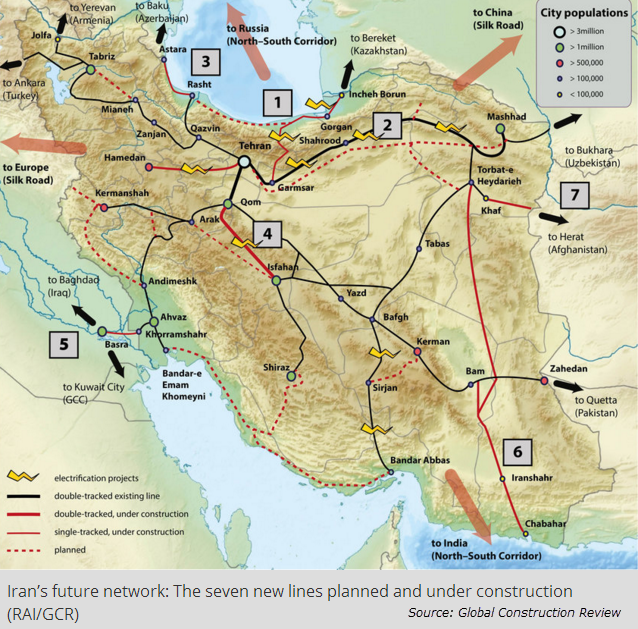

Global Construction Review showcases seven of the most significant international freight forwarding routes that are either already in progress, or opening up new trade frontiers in the near future.

1. Tehran to Turkmenistan: Central Asia

A historic line already exists from Tehran north-east to Turkmenistan, but upgrades to tracks and infrastructure promise speedier freight logistics on this route. This rail line was part of Iran’s first great national railway, the Trans-Iranian, built almost one hundred years ago, between 1927 and 1938. It is in need of electrification.

Russia, Turkmenistan and Kazakhstan, former Soviet Central Asian Republics bordering the Caspian Sea and the Persian Gulf stand to see an increase in their freight cargo for over land and sea via this north-south rail route. Speedier transportation of goods will be a huge advantage when the $1.3bn referred to by RAI’s Director is invested to electrify the 495km section of rail from Tehran.

This deal was agreed in November 2015 between, RAI and Russia Railways subsidiary, RZD and will last three years. It includes building “power stations and overhead lines, 32 new train stations and widening 95 tunnels” to allow for the larger Soviet freight trains. Poursaeed-Aqaei stated that these improvements could increase freight carrying capacity of the line to 8 million tonnes of goods each year.

The Russian government is funding this route with $5bn export credit, with the agreement that all electric locomotives will be manufactured in Iran, with huge benefits for Iranian transportation technology companies and their suppliers. Each stand to gain from increased business, skills development, increased technological expertise and jobs. Villages, such as Incheh Burun could become boom towns as suppliers or stops along the major Eurasian arterial route.

Iran, Kazakhstan and Turkmenistan may, according to Kazakh President Nursultan Nazarbayev, rocket imports and exports from the present 3 million tonnes of cargo a year to 20 million tonnes by 2020, as quoted in The Railway Gazette.

2. China, Central Asia, Eastern Europe Connections

Chinese investors will be electrifying the rail-line running roughly parallel to the Turkmenistan north-south rail route, a 1,000km double-tracked route between Tehran and the city of Mashhad. This is being financed with an 85% loan, as part of a $2.1bn deal agreed last June.

Trains running at a speed of 250 km/h are expected to cut passenger journey in half down to six hours, whilst container transport will run at 120 km/h and increase rail freight capacity to 10 million tonnes a year.

Completion of this work is expected to take around four years and includes five-years’ maintenance support. The Iranian infrastructure engineer Mapna Group will be partnering with China’s CMC and SU Power companies to deliver this project.

This and Incheh Borun route are part of China Railway Corporation’s strategic objective of bringing the classic Silk Road into the twenty-first century, as proposed by its Chief Engineer, He Huawu.

The new Silk Road route runs from Urumqi in western China, via Kazakhstan, Uzbekistan, and Turkmenistan’s capital Ashgabat, then comes south into Mashhad. This is then the connection for Iran’s east-west rail network opening faster access to Turkey and Eastern Europe.

3. Iran to Moscow via Azerbaijan’s Land Bridge and the INSTC

The International North-South Transport Corridor (INSTC) running from Russia down through Azerbaijan, to Iran and the Persian Gulf offer many opportunities for Iranian companies seeking to build businesses with Russian partners. This is part of Russia’s objectives of tapping into Indian and Southeast Asian markets via the Indian Ocean.

Former Soviet railway transport passed from Azerbaijan and Armenia, but these are no longer viable routes, due to regional conflicts, making INSTC vital for their expansion.

Iran, Russia and Azerbaijan agreed last May that Russia would construct this 170km rail freight route from Rasht on Iran’s northern Caspian coast, to Astara on Azerbaijan’s southern tip. RAI has already built the 200km Qazvin-Rasht section, but allegedly ran out of funds, frustrating Russian officials keen to see completion.

The INSTC Rasht rail corridor will branch off Iran’s main northwest line at Qazvin, then cross the mountains to the Caspian coast to Astara. This serves India’s as well as Russian aims too, giving overland access to Western Europe. When officially opened this year, Astara will be turned into a special economic zone, giving financial incentives to companies seeking import and export opportunities here. Watch this space for potential funding for Armenian connections from China.

4. Iran’s High-Speed Railway Showcase

The high speed rail link between the Tehran, Qom and Isfahan is going to set the standard for the entire network as a showcase modern double-tracked line running at 400km/h for passengers. This is currently the only high-speed project actually under way as we write.

The China Railway Engineering Corporation and Iran’s Khatam Al Anbia Construction began work in February 2015 on this $2.7bn partner project, scheduled for completion by 2019. Iran’s Bank of Industry and Mine will provide $1.8bn of the budget for this project, underwritten by the China Export and Credit Insurance Corporation.

Design of stations is the responsibility of AREP, a branch of French state-owned rail operator SNCF. Existing stations will be upgraded and new ones built. Tehran, Qom and Mashhad will be rebuilt as modern mixed transport hubs.

Etienne Tricaud, the Head of Arep’s Board of Directors, said: “Tehran railway station is …not compatible with present-day needs. We have to present a comprehensive plan …so that high-speed inner-city and suburban trains, as well as electric and metro trains, can transport passengers in the city centre.”

A Qom–Kermanshah line is under consideration by the Iranian Ministry of Road and Urban Development, but negotiations with potential partners have so far have failed to bring results, but this is a space to watch in 2016.

5. Basra, Iraq Joins The Silk Road

June 2015 saw new tracks being laid down between Khorramshahr and Basra in Iraq, close to the Persian Gulf. This offers a junction between the Silk Road and the regional rail system being built by the Gulf Co-operation Council countries (Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain, and Oman). A 12km length of track laid on the Iranian side of the border will complete this Silk Road corridor section, together with a bridge over the Arvand River and a 32km railway on the Iraq side.

As many as 20,000 Iranians use the Shalamcheh Iraqi border crossing daily and 50,000 cross during Shia religious anniversaries, when travelling to Karbala, Najaf and Baghdad. A year from now, these journeys will become faster and more comfortable for Iranians.

Abbas Akhoundi, Iran’s Minister of Roads and Urban Development, said in June that this route also offered new connections to Eastern Mediterranian countries and: “…lead to a transformational change in the transit of goods and passengers.”

6. The India-Russia Corridor

Chabahar is Iran’s southernmost city giving the best access to the Indian ocean via on-going port redevelopment on the Gulf of Oman. Former president Mahmud Ahmadinejad called the port “Iran’s Eastern Corridor” connecting people and businesses to Southern Asia, Arabian Sea and Indian Ocean nations.

India is heavily involved in enhancement of the Chabahar port. India also wants to compete with the Chinese-built port along the coast at Gwadar in Pakistan.

Rail freight from Chabahar or Bandar Abbas takes around 30 days to travel by rail to Bandar Anzali on the Caspian Sea for freight shipping to the Kazakh rail system onto St Petersburg. The traditional Suez route took 45-60 days.

Tehran is seeking India’s support for a 500km stretch of railway between Chabahar Port and the line between Ban and Zahedan, located near Iran’s south eastern borders with Pakistan and Afghanistan, however, India is unlikely to support Pakistani connections. Nevertheless, this would complete Chabahar’s connection with Iran’s main rail system and give Indian companies access to markets beyond Azerbaijan and Turkmenistan.

The Indian Press have described negotiations over terms of this deal as bumpy, given Delhi’s concerns over any future Iranian government’s expropriate of any stake they invest. However, the deal is going ahead, given India’s need to by-pass Pakistan to reach northern markets.

7. $3 Trillion Prize Railway

Tehran are now completing a railway to Herat from the line currently under construction between Chabahar and Torbat-e Heydarieh; this line is now about halfway to the border. The Afghan President, Ashraf Ghani Ahmadzai, has also apparently expressed support for continuing the line into Afghanistan, after local lobbying by Afghan officials.

Iranian officials seems willing to pay for the link to Herat and plans are underway for an extension to Mazar-i-Sharif in the north, as the only significant city with a rail service going north to Uzbekhistan.

A rail link across Afghanistan offers a direct route between Iran and China and a vital source of economic recovery for the country still suffering with extremist activities. At present, Afghanistan’s vast mineral wealth is still under-exploited.

A rail freight route to Herat opens up exploitation of Afghanistan’s iron ore rich Hajigak region, Asia’s largest deposits, estimated at around $3 trillion in value and highly prized by resource hungry China. This explains their willingness to finance the Chabahar railway.

The main difficulties, beyond the ‘bumpy negotiations’, as reported by the Times of India, however, remain those of operating in Afghanistan on what has been dubbed by the British press as the ‘world’s most dangerous railroad’.

Conclusion

When sanctions against Iran are over, the push will really be on for companies such as the White Rose Group to keep up with the burgeoning demand for transportation and logistics support services, but we are excited about where freight logistics are heading in 2016. Developments create golden opportunities for partner countries to invest and for companies doing business with Iran, across a wide range of industries. Commentators expect a real boom for construction and technology manufacturers, which the White Rose Group also has interests in. Wider growth coming this year will allow for Iran’s main oil and gas industries to flourish in the new trading environment too, bringing further opportunities for everyone.

Iran is about to emerge as the country that regional partners will have to work with to optimise their transportation logistics and cut costs. Companies seeking to exploit developments will need to identify international project management professionals who are well placed to make the connections and resolve logistics challenges. Business eyes looking for expansion will be watching and so will we, so be sure to watch our blog for the latest news coming through and get in touch to find out how we can help you get the most from Iran’s boom times ahead.

our contact form.

The White Rose Group looks forward to hearing from you.