Russian Manufacturer Supplies Iran with 500 Rail Trucks

15 Feb 2016

Russia and Iran have a mutual interest in expanding their ground freight shipping and in the lead up to the re-opening up of international trade with Iran, post-sanctions, both parties have been negotiating freight forwarding options.

Russia wants to strategically expand its transportation and logistics networks to Iran, but there are on-going challenges, in the shape of the Caucasus Mountains, where geo-political relations can be sensitive or even outright hostile. Nevertheless, Moscow and Tehran are trying to overcome these significant obstacles to efficiently linked international transportation infrastructure.

Russia’s Overland Transport Developments

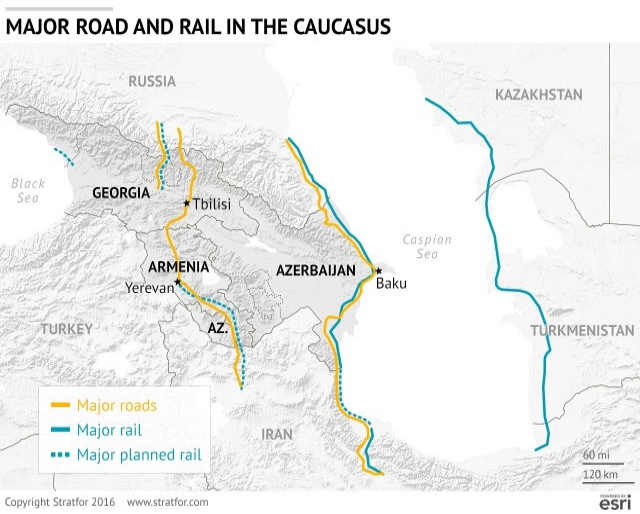

Russia has already constructed two roads through the South Caucasus to Iran, according to the Stratfor Global Intelligence agency. The first road freight route traces the Caspian Sea coast, through Dagestan and Azerbaijan; the second route follows the Georgian Military Road through the Jvari Pass in the Caucasus Mountains.

The Caspian route will serve Azerbaijani aims to develop international trade links with her larger trading partners, albeit the relationship between Azerbaijan and Iran has not always ran smoothly. The Jvari Pass road is often closed in winter. This makes it problematic in terms of heavy trucking between the two countries.

Rail freight south from Russian has been another area of investment in recent years. Both western and eastern sides of the Caspian Sea are options. In 2014, freight train routes passing through Kazakhstan and Turkmenistan were opened up.

Iran’s Overland Trade Routes Continue

Iran is still constructing the Qazvin-Rasht-Astara railway on Iran’s Caspian shore. When complete, the railway line will open north-south international freight transport links from Iran through Azerbaijan, to Russia and Europe. The only limit to permissible freight here is transportation of Russian military equipment through Azerbaijan and Turkmenistan, a key concern to Russia. Moscow recognises its need to widen their options for alternative transportation logistics.

One option is construction of a road leading from the North Caucasus to the Georgian breakaway territory of South Ossetia, before connecting with the important East-West highway, which links Azerbaijan to Georgia's Black Sea ports. Alternatively, around 160 kilometers (about 100 miles) of railway could link Alagir, in the North Caucasus, to Gori, in Georgia. Either route would mean Russia could conveniently connect to every South Caucasus country. Rail freight infrastructure through Abkhazia is also a possibility for Moscow to consider for investment.

The geo-politics of this region and Russia’s review of foreign investment will decide matters ultimately. Last year, Russian forces completed part of the rail line which now extends to other parts of Georgia. Abkhazian sees this as an important step to the full restoration of this railway route, but Tbilisi could be an effective blockage en route, given tensions around Georgia and its breakaway territories.

Nevertheless, Tehran and Moscow have either completed or continue with ongoing rail transportation developments in Abkhazia, South Ossetia and Azerbaijan. Iran and Russia both want effective and reliable international transportation solutions which navigate the Caucasus “while keeping other foreign competitors out”, according to Stratfor Intelligence.

As part of this partnership, the Russian manufacturer Uralvagonzavod will supply Iran with 5,000 rail freight cars. This is just the start of Russian export to Iran since the easing of sanctions against Iran and delivery is likely before the end of the year.

According to Kommersant, Russia's state development bank Vnesheconombank (VEB) will be loaning 11.2 bln rubles (USD140 million) to the company to facilitate this trade from which Iranian Railways will be able to replace old rolling stock.

VEB’s may also subsidise exports of 15,000 rail cars to neighbouring Azerbaijan, Kazakhstan, as well as other trade partners.

The Iranian Ambassador to Russia, Mehdi Sanaei announced that Tehran expects joint Russian-Iranian projects initiated last year to see tangible progress this year. Joint transportation and logistics projects discussed involve large Russian companies and key Iranian companies. Contracts were valued as over $25 billion altogether, offering massive

import and export business opportunities for both sides, as reported elsewhere by the White Rose Group.

Credit to Stratfor Global Intelligence for the image.

our contact form.

The White Rose Group looks forward to hearing from you.